Why do you have to plan where to live?

Your home, you already made that decision!!! However, the cost of living has soared, and taking care of a home becomes more difficult as we age, forcing retires to sell and move from their homes. Sound familiar?

Upon further examination

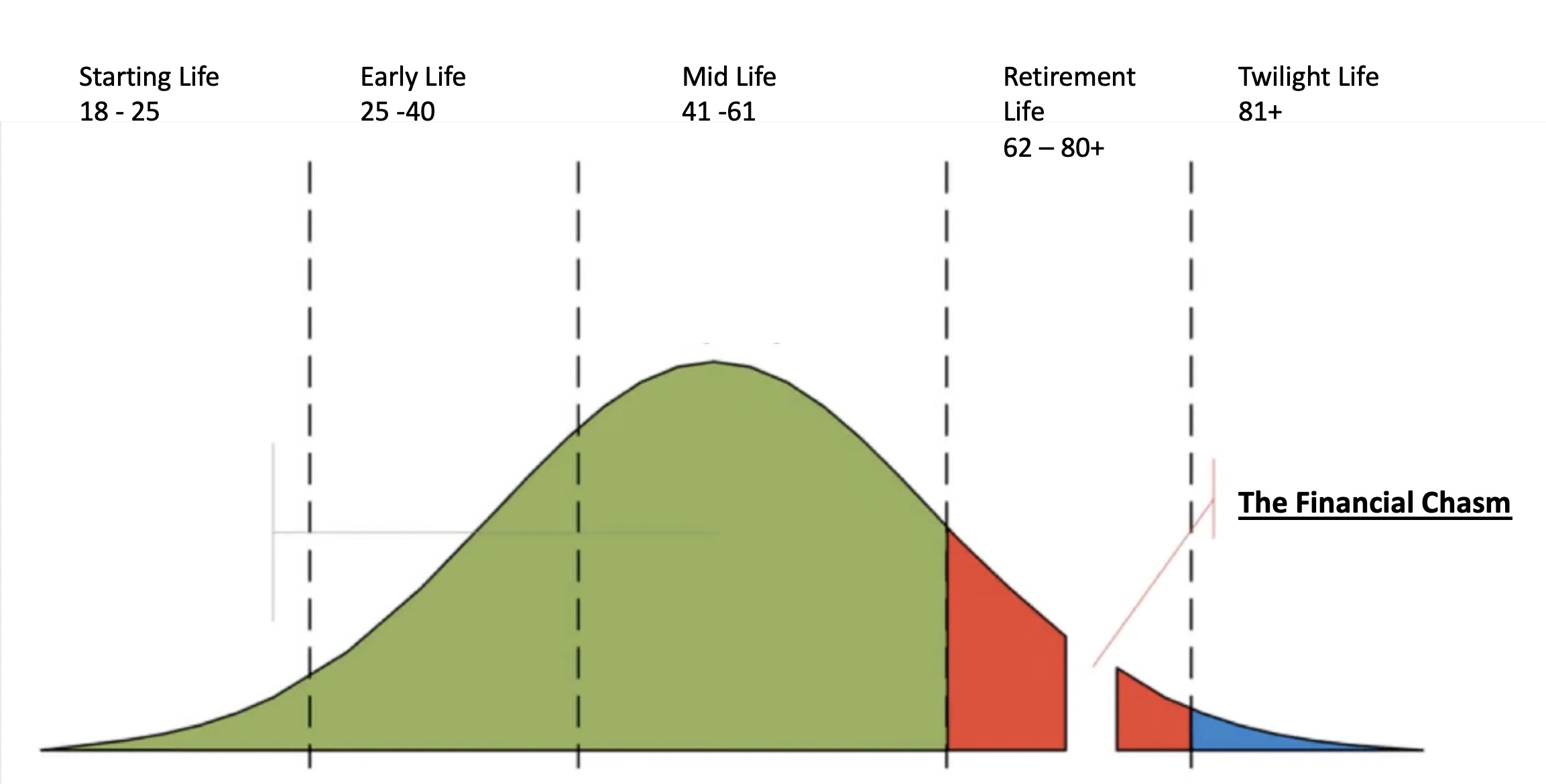

What is the Financial Chasm?

People in their 50s and 60s are racing towards another chasm. We did not acknowledge this chasm we were facing, which is a financial chasm to pay for our retirement. Many of us lived very well and enjoyed a hectic and wild lifestyle of having cash on hand to buy things we wanted when we wanted. Taking on vast amounts of debt simply because we knew that paycheck was coming, but those days are over.

Once we retire, whether we retire at 62, 65, or even 70, we have to start thinking about reducing expenses and living within the means of our retirement funds. Some of us have amassed significant wealth to live the same lifestyle we were always living straight until the end of our lives. How awesome is that? However, most seniors realize that what they accumulated and amassed, either through lack of planning or no-fault, is not enough to live their lives out. They will rely on government Social Security and try to preserve their little nest egg for rainy days. How many rainy days can your nest egg endure if your property needs a roof, clogged septic, rising property taxes, or general maintenance? It can erode that nest egg very quickly. If you plan to move to a rental in 2022 with the cost of rental properties being extremely high, that can also erode that nest egg significantly quicker than expected. Can health issues deteriorate the nest egg to the point where one needs to decide whether you maintain your property or your health?

What if you could lock in your expenses to just food and utilities? That nest egg can go as long as you expect it. Locking in your cost is a footpath to cross that chasm and get to the other side to live out your years in peace.

New Stewardship of Your Home....Problem solved!

To solve this problem is a simple business equation, increase income, lower expenses, or both.

By changing stewardship from yourself to Four Corner Society, you now have the freedom to stay in your home and enjoy it, knowing that care and upkeep are in competent hands. Plainly stated, Four Corners of Society address anything full maintenance of the property and locks your expenses.